Overview:

I wrote a custom script to ingest the data and calculate the total arbitrage in the past 3 months.

More data can be found in this repo: https://github.com/0xMisaka/MEV-data-solana.

Method of Analysis at the bottom.

Twitter Thread here:

Here are what I found:

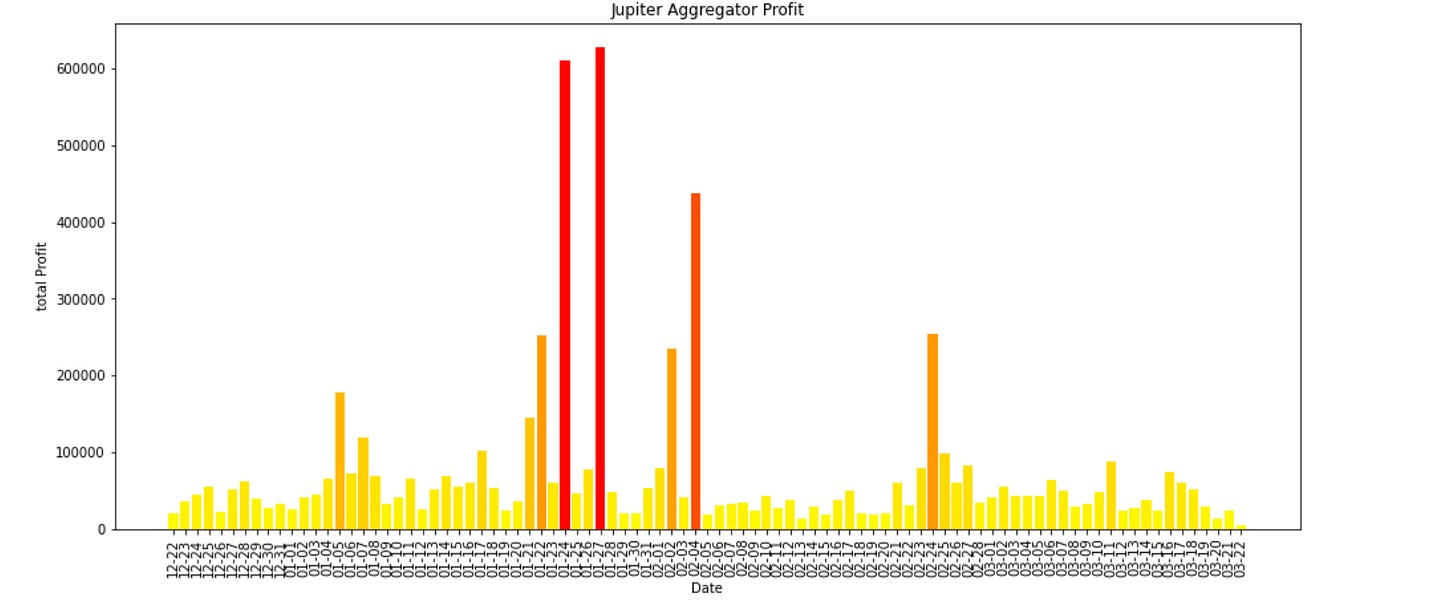

There were $20m of arbitrage profit made in the past 90 days. Here is the time vs. profit chart

However, it's important to note that the number goes down to $7m if not including $13m of arbitrage 30 minutes after the wormhole incident.

I made a separate thread a few weeks ago about arbitrage during wormhole here:

From here, I will only talk about non-wormhole data:

Breakdown by Month:

Jan: $3,190,717

Feb: $1,942,895 + ($13m wormhole)

Mar (so far): $905,522

Top Bots:

The top bot made $606,013 🥇 of arbitrage profit. Second 🥈 and third 🥉place closely trailing at $548,661 and $492,319.12

Another thing to remember is that bots often change the address; actual numbers might be higher.

Breakdown:

The top 10 bots account for 53% or $3.71m/ $7m of all arbitrage profits.

Here is the percentage breakdown

Largest Profit Txs:

Breakdown by DEXes:

There were 3,431,783 total profitable transactions within 90 days with most of them being

1) Serum:954,842

2) Orca: 884,340

3) Raydium: 625,083

4) @JupiterExchange : 619489

Here is the chart

Average profit per Txs breakdown by month:

Jan: $4.48

Feb: $7.07

Mar (so far): $2.52

As you can see it's not a lot, so a lot of Bots are just looking to hit the long tail homerun.

Part2 Coming soon:

Another note is that this analysis only includes atomic arbitrage and not statistical arbitrage, liquidation, or basis,

so there are more profits than shown here.

Here is the teaser for part2: More than $30m in liquidation MEV

Solid information Ser. Just curious, is it possible for normie with little programming experience to build and deploy MEV bot and will it be profitable with small amount of money ? Is the opportunity in Solana better than in Ethereum ?