Overview:

During the 30 minutes between 18:30:32 - 19:00:32, there were $5,955,161 USDC, and 70,915 SOL totaling $13m of profit made from arbitrage.

With most profit made in 30 seconds between 18:34:30 - 18:35:00 in which $2,316,194 USDC and 58,497 SOL totaling $7.3 million.

This happened due to the attacker dumping his stolen $51,000,000 worth of $ETH on the market causing a huge price imbalance between exchanges.

Dumping transaction can be seen here: Transaction in which attacker dumps ETH for SOL

First, it's important to note that this thread does not bash the Wormhole team. On the contrary, I think the Wormhole team handled this situation appropriately and came out stronger from the incident.

This article will analyze the data on total arbitrage profits during 30 minutes between 18:30:32 - 19:00:32 (Golden Minutes) and 30 seconds between 18:34:30 - 18:35:00 on Feb 2nd, 2022. Method of Analysis can be found at the bottom.

Top Performing bots:

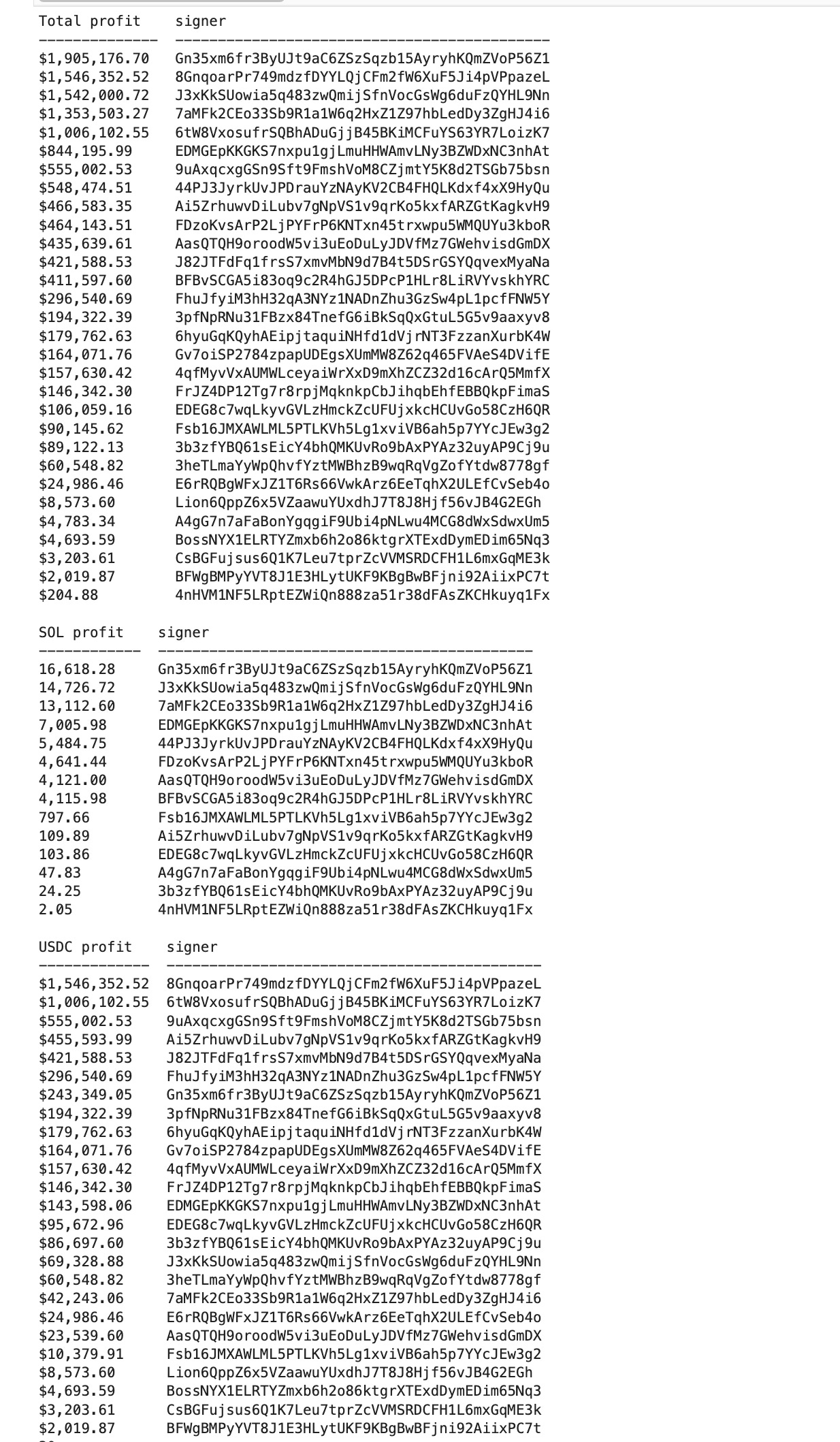

The best bot made $1,905,176.70 of arbitrage profit in that 30 minutes with second and third place closely trailing at $1.6m each

Below is the breakdown of total profit, SOL profit and USDC profit

The top 10 bots account for 65% or $8.5m / $13m of all arbitrage profits in that 30 minutes, and here is the percentage breakdown.

Biggest profit: $500k profit from a Single Transaction

The 3 largest profits from a single transaction made:

1) 4981 Sol ~ 500k,

2) 4937 Sol ~ 500k

3) $297,849 USDC

What this says is if you were running any bot that week, you were instantly making $40k minimum.

Below is the detailed breakdown of the top 50 transactions.

Breakdown by DEXes

There were 12,422 total profitable transactions within that 30 minutes with most of them being:

Orca: 4477

Serum: 3331

Raydium: 2022

Here are the charts:

What does all this mean:

To put this in perspective, the week before, there were only $1,024,382 USDC and 1,440 SOL totaling $2m of profit made the whole week.

Here is the list of top bots of the week before:

It's important to note these were the extremely long tail and do not represent the typical profit landscape of arbitrage on Solana.

eg. there were only $300k of arbitrage profit made this entire week on Solana. In addition, most arbitrage transactions did not land and ended up in a failed transaction.

Another note is this analysis only includes atomic arbitrage and not statistical arbitrage or liquidation, so there might more profits than what's shown here.

Although this should be most of it because of force dumping of ETH on DEX.

what is MEV??? :)